2020 unemployment insurance tax refund

They agreed to trim extended weekly. Thats the same data the IRS released on November 1.

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Based On Circumstances You May Already Qualify For Tax Relief.

. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. 22 2022 Published 742 am. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

The Vermont Department of Taxes has begun issuing refunds to eligible taxpayers who received unemployment insurance benefits. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

By Anuradha Garg. 761 2020 Southern Cumberland 856. Tue 09142021 - 1200.

President Joe Biden signed the pandemic relief law in. Free Case Review Begin Online. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. 2020-117 A motion was made by Mayor McEvoy. Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts.

The unemployment income exemption is the result of a compromise between Democrats and Republicans to get the package passed. This threshold applies to all filing statuses and it doesnt double to. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT CHRIS CHRISTIE.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. For some there will be no. Check For The Latest Updates And Resources Throughout The Tax Season.

2020 92969 or less. The IRS has sent 87 million unemployment compensation refunds so far. Ad See If You Qualify For IRS Fresh Start Program.

Seconded by Councilman Ryan that the following resolution be adopted. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Your total annual income combined if you were married or in a civil union and lived in the same home was.

AUTHORIZING THE REFUND OF TAX PAYMENTS DUE. 2021 94178 or less.

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

2020 Tax Tips Unemployment Furloughs Stimulus Payments How They Impact Your Tax Filings Atlantic Financial Fcu Baltimore Md Hunt Valley Md

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Irs Says Unemployment Refunds Will Start Being Sent In May Here S How To Get Yours

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

If You Got Unemployment In 2020 You May Get A Surprise Tax Refund Tax Refund Free Tax Filing Tax Deadline

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Learn C Online 360p Learn C Learning Methods Learning

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

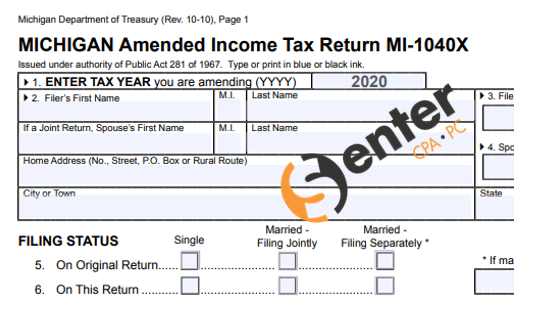

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com